Investment

Thesis

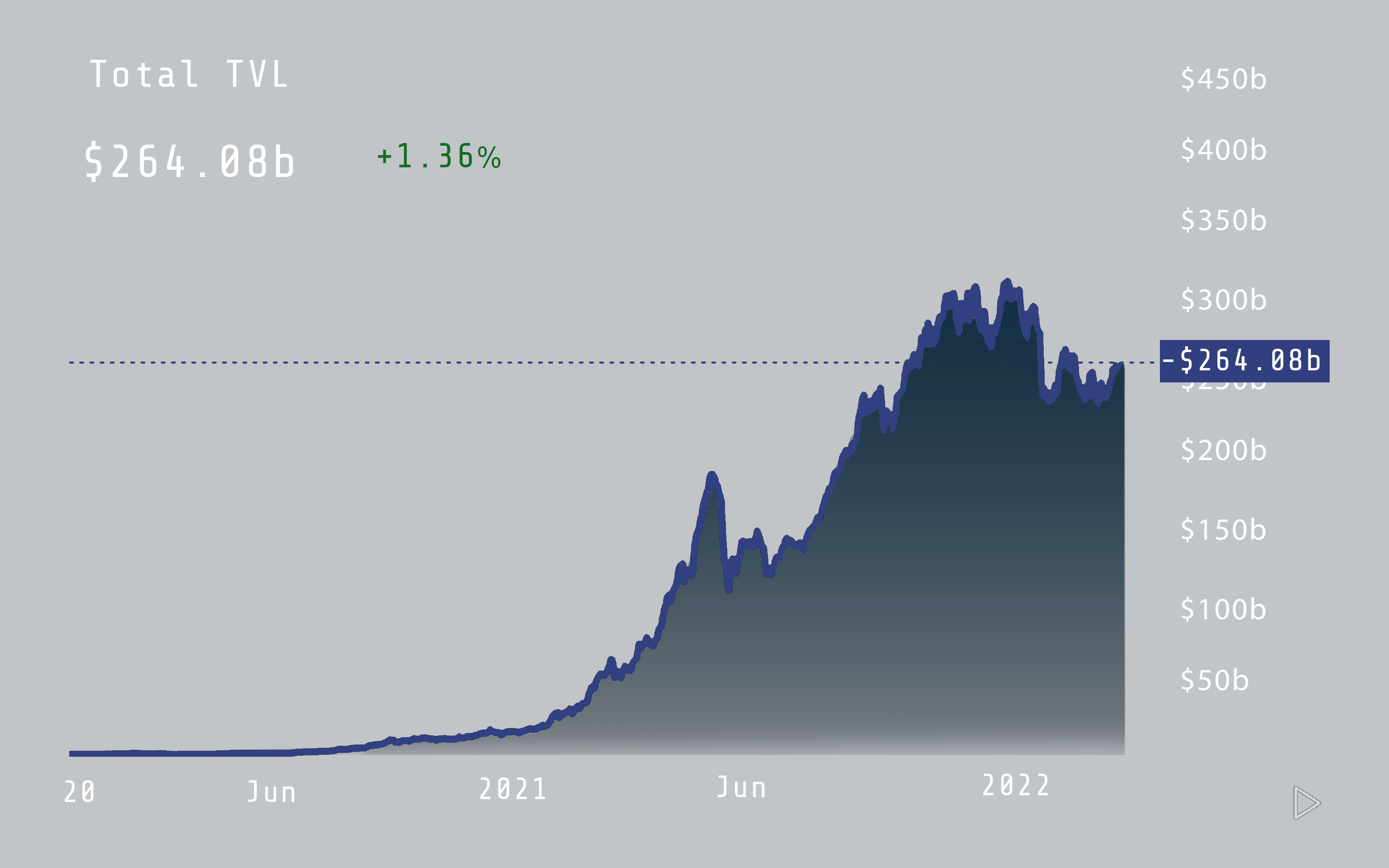

The bullcase for DeFi

2020 proved to be a pivotal year for DeFi, as it grew from $700M USD in Total Value Locked(TVL) in the field in December of 2019 to $20B USD by year-end 2020. In 2021 and early 2022 the trend continued, accelerating Defi investment levels to a total of $230 bn today(DeFi Llama, 2022). Bulls, such as ourselves, believe DeFi will eventually replace the legacy financial system with its layers of intermediaries, restrictions on capital deployment, and antiquated financial products. For those who witnessed the effect that the open, permissionless internet had on the media and music industries, it’s clear what happens to those who don’t even attempt to innovate: disruption.

Asset Allocation

Asset allocation within the cryptocurrency industry is a fine balancing act of game theory, economics and finance - with the rewards being far greater than most (if not all) other asset classes. In an asset class renowned for its volatility, we maintain a healthy risk-reward ratio in all of our positions, with stable positions deployed at all times to ensure a steady return. We deploy capital in protocols deemed to be prudent investments given their standing in the relevant ecosystem, alongside key metrics which we believe are important in evaluating the robustness of an investment. These metrics can be split into quantitative and qualitative criteria:

| Quantitative Criteria | Qualitative Criteria |

|---|---|

| TVL | Innovation on base layer |

| APY Runway | Strength of team |

| Rebase Policy | Community Engagement |

| Tokenomics/Emissions | Roadmap |

| Macro Market Sentiment | Current Marketing |

Fund Model ->